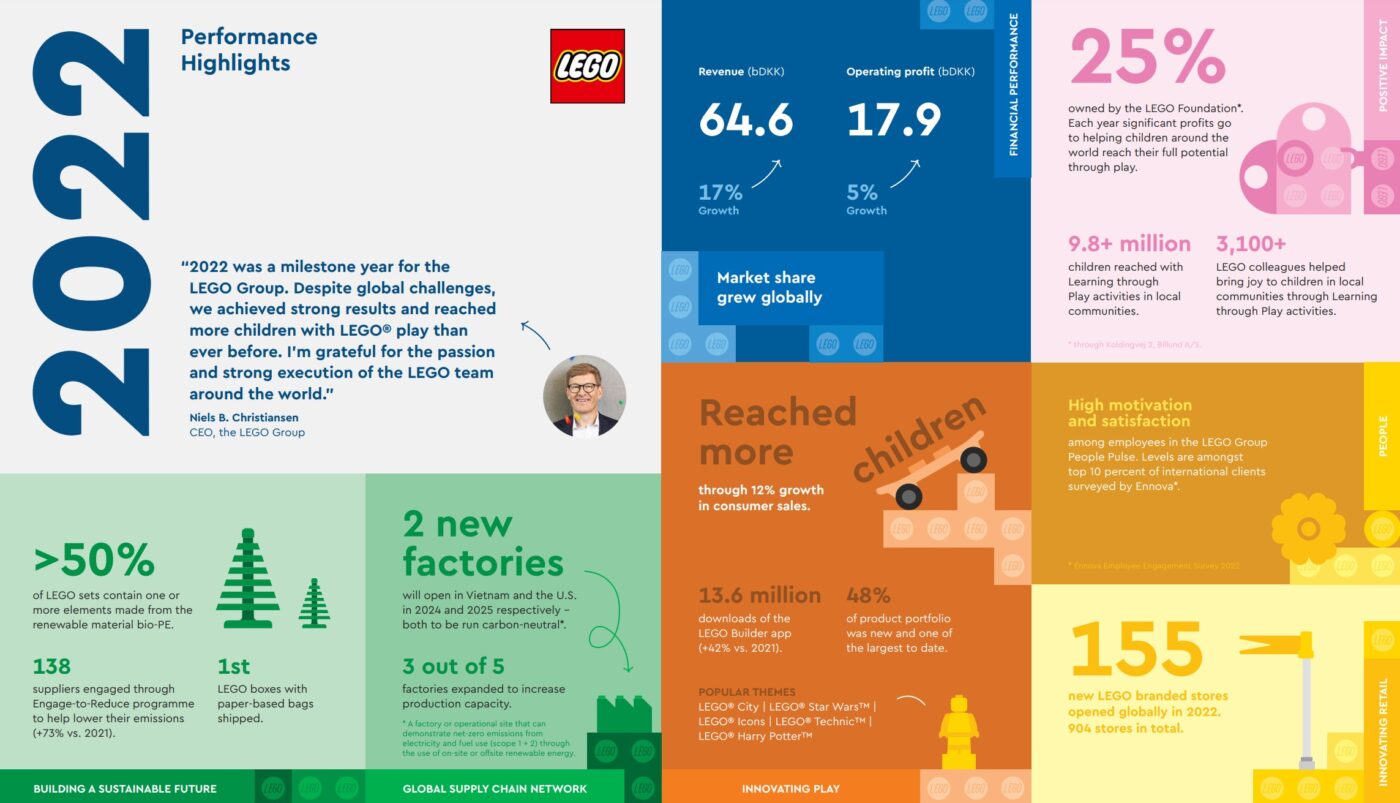

LEGO’s 2022 full year financial results are out – another record-breaking year, but profits take a hit

4

4

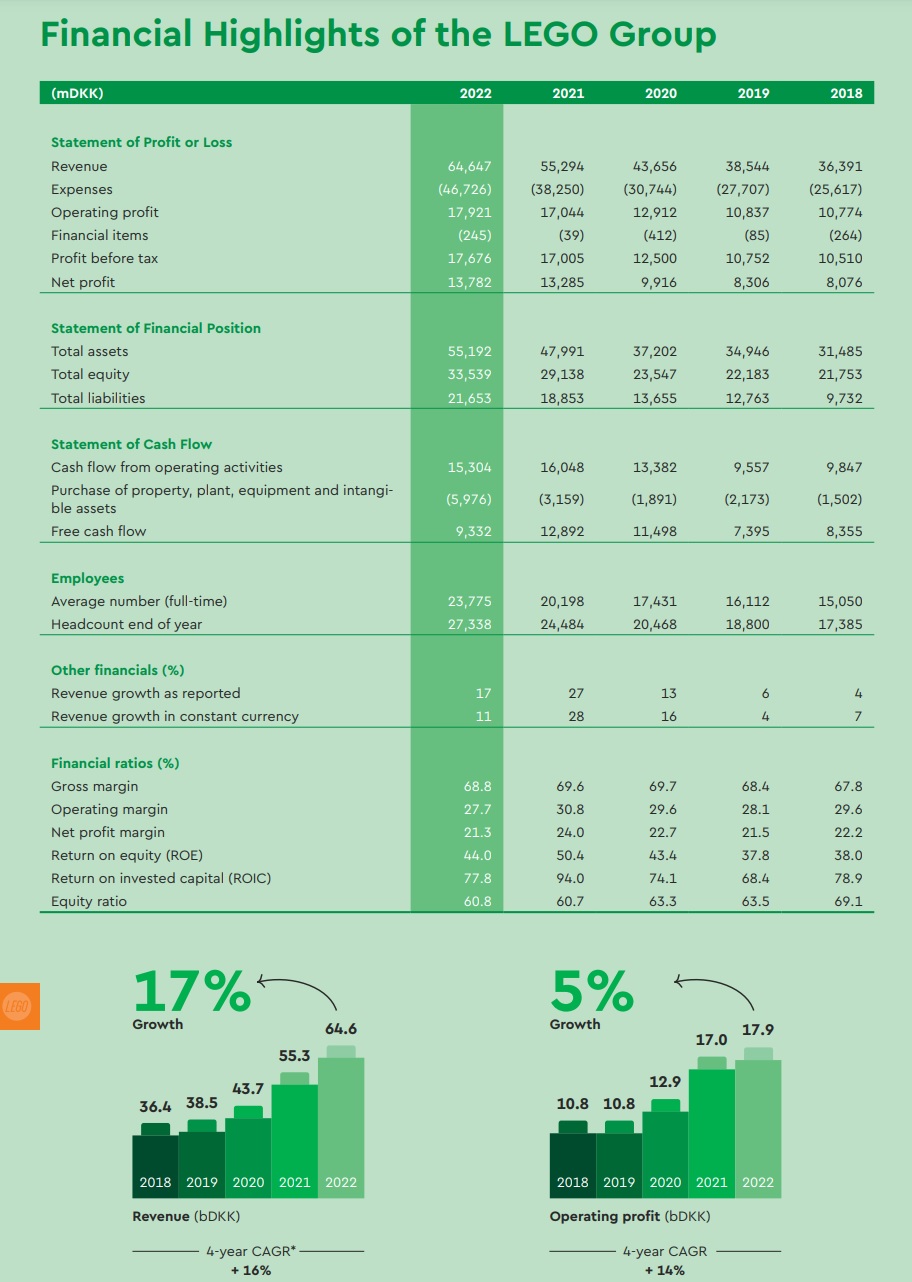

LEGO Financial Results Summary:

- Marks its 90th anniversary reaching more children with LEGO® play than ever before

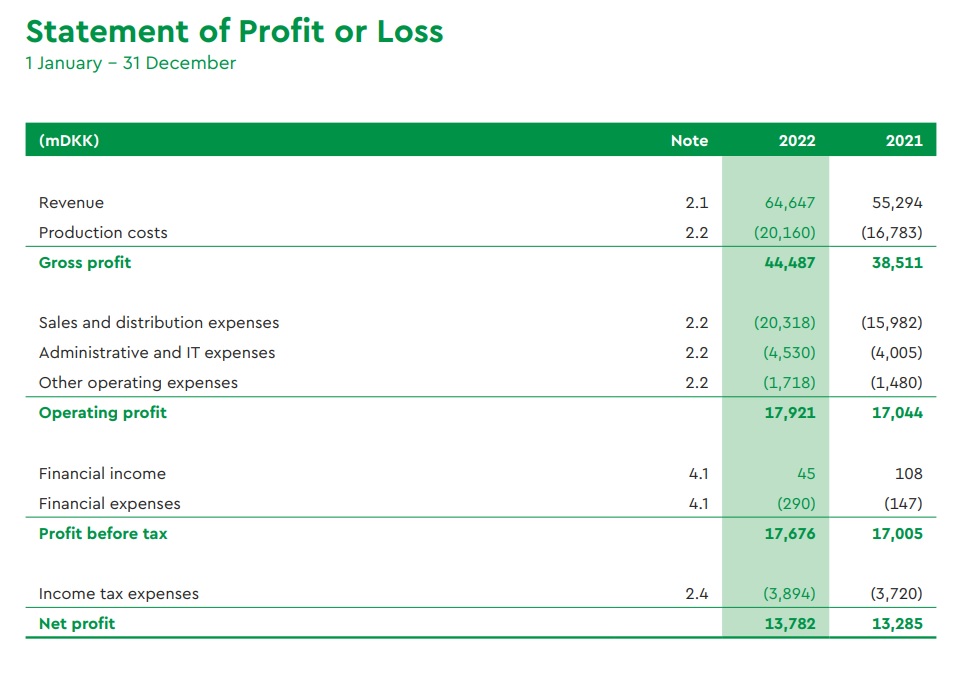

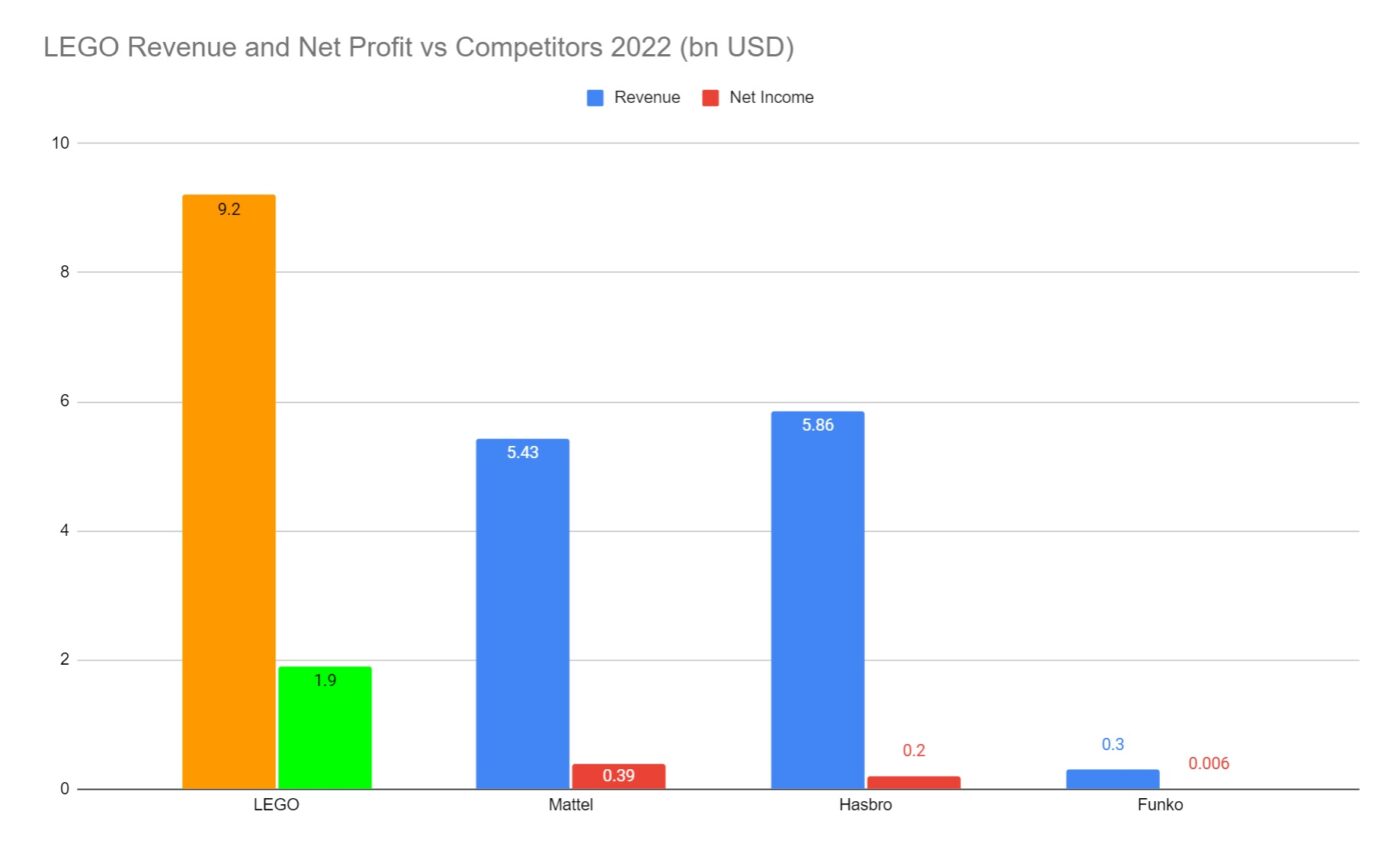

- Revenue grew 17 percent to DKK 64.6 billion (US$9.2 billion)

- Operating profit grew 5 percent to DKK 17.9 billion. Net profit grew 4 percent to DKK 13.8 billion (US$1.9 bn)

- Free cash flow was DKK 9.3 billion (US$1.3bn)

- Market share grew globally.

- Momentum driven by large-scale investments in long-term strategic initiatives.

The LEGO Group today reported earnings for the full year of 2022, with LEGO registering another record-breaking year for revenue, which grew 17 percent to DKK 64.6 billion (US$9.2 billion).

You can download and view the full annual report here

Unfortunately, net profit only grew 4% to DKK 13.8 billion (US$1.9 bn) with consumer sales grew 12 percent in 2022, achieving growth in all major market groups with especially strong performance in the Americas and Western Europe.

Unfortunately, it isn’t as rosy as previous years as net income has declined, against the backdrop of high inflation and slowing discretionary spending by consumers.

All market groups delivered double-digit consumer sales growth thanks to strong execution and the largest and most diverse portfolio ever that brought families together and appealed to builders of all ages and interests.

LEGO’s top-selling themes in 2022 were (in no particular order)

- LEGO® City

- LEGO® Technic

- LEGO® Icons

- LEGO® Harry Potter™

- LEGO® Star Wars™

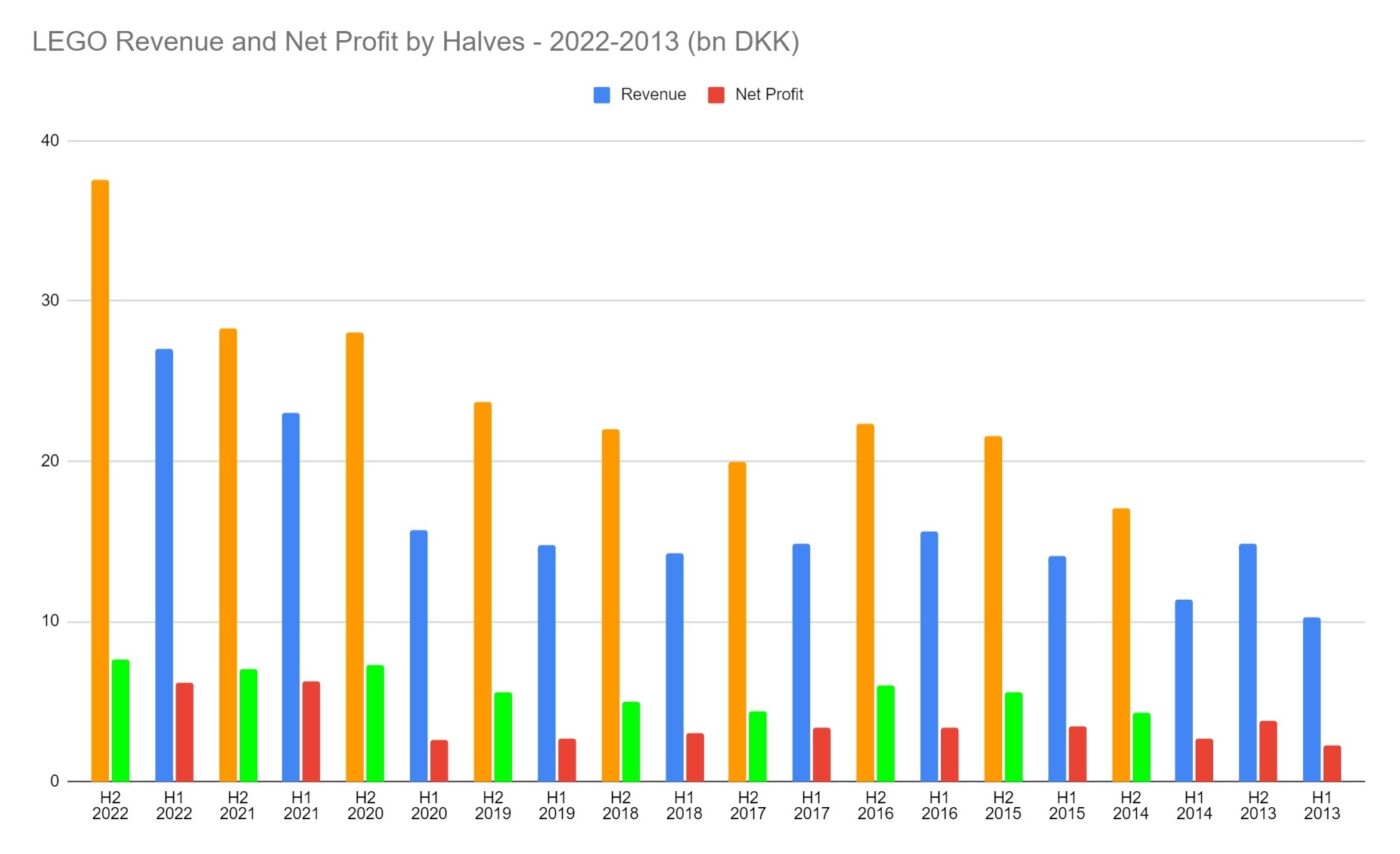

Here’s a look at the breakdown of growth by halves.

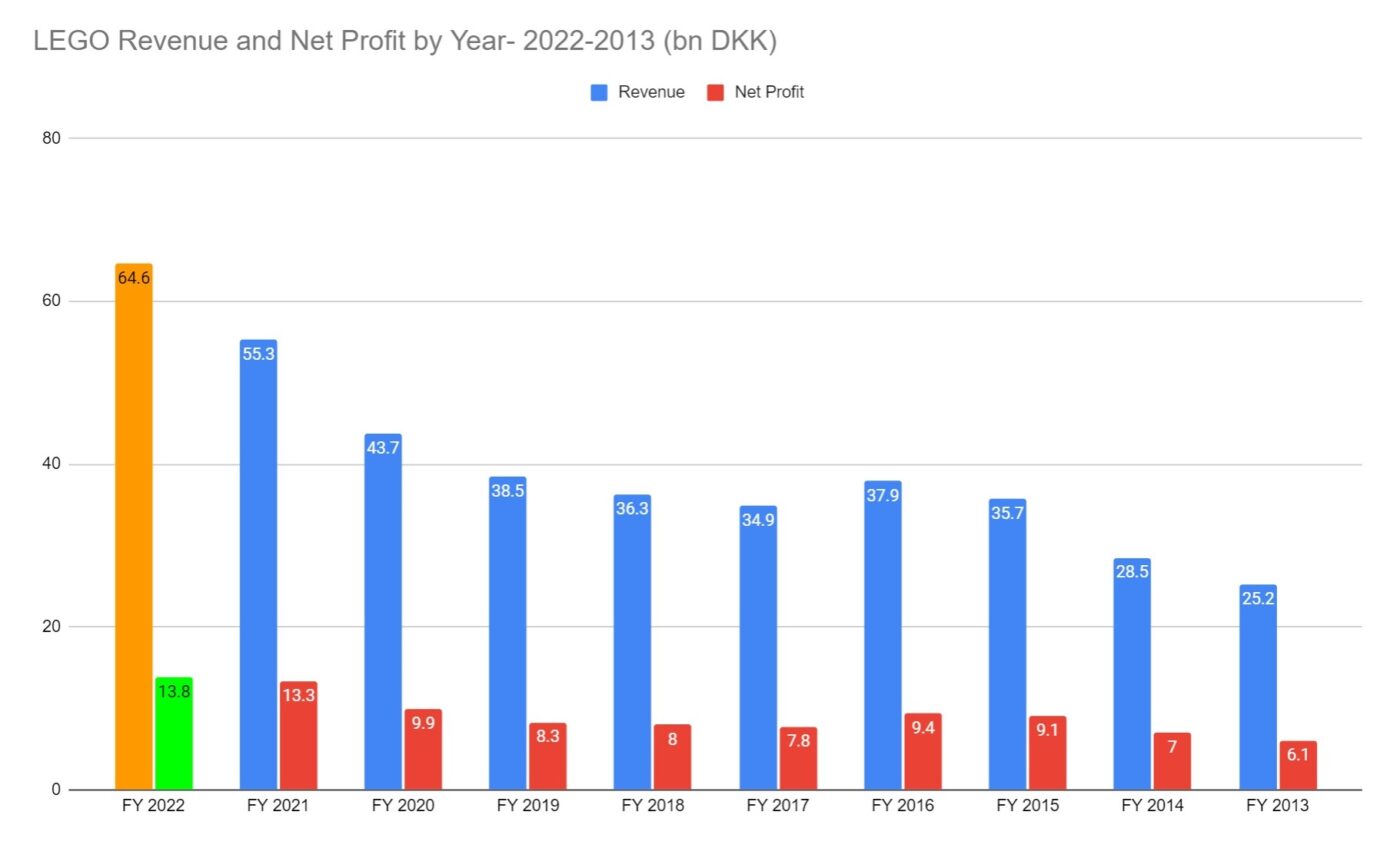

And broken down into years, going all the way back to 2013.

The LEGO Group CEO, Niels B. Christiansen said: “2022 was a milestone year for the LEGO Group as we celebrated our 90th anniversary. Our strong results show that the LEGO System in Play is more relevant and appealing than ever.”

“I am very satisfied with our performance. We achieved double digit top line growth and landed the year beyond expectations on the back of exceptional growth last year and despite challenging market conditions. This was due to our relevant brand, a fantastic, diverse portfolio, inspiring shopping experiences and outstanding execution from our teams.”

Operating profit increased 5 percent to DKK 17.9 billion, up from DKK 17 billion in 2021. Net profit was DKK 13.8 billion, a 4 percent rise from DKK 13.3 billion compared to last year. These results were delivered despite extraordinary inflationary pressures on materials, freight and energy costs. Free cash flow was DKK 9.3 billion against DKK 12.9 billion in 2021, driven by increased capital investments in areas such as production capacity.

Strong appeal of diverse portfolio

Consumer sales grew 12 percent in 2022, achieving growth in all major market groups with especially strong performance in the Americas and Western Europe.

The company reached more children than ever before with its large and diverse portfolio. 48 percent of products were new, designed to appeal to builders of all ages, passions and interests. Some of the top themes included homegrown ranges such as LEGO® City, LEGO® Icons and LEGO® Technic™, as well as themes with intellectual property partners such as LEGO® Star Wars™ and LEGO® Harry Potter™.

Strategic initiatives driving momentum

In 2022, the LEGO Group continued to accelerate its investments in strategic initiatives, such as retail channels, product innovation, own and partners’ retail platforms instore and online, production capacity, digitalisation and sustainability.

Christiansen said: “The momentum we have seen during the past years continued in 2022. It was driven by the investments made during this time which are both paying off now and establishing a foundation for long-term, sustainable growth. We plan to accelerate investments in strategic initiatives in the coming years to build long-term relevance and growth of our brand.”

During the year, the LEGO Group opened 155 new LEGO branded stores, reaching a total number of 904 stores globally. The company also made further progress on capacity expansion projects at three of its factories, broke ground on a new carbon-neutral run factory in Binh Duong, Vietnam, and announced plans to build a carbon-neutral run factory in Richmond, VA, USA to meet future demand in the Americas. It also accelerated investments in its digital transformation across the business which delivered wide-ranging benefits including improved online experiences for shoppers and partners and expanded building experiences for consumers.

The company expects single digit revenue growth in 2023, ahead of the global toy market and will continue to accelerate investments in strategic initiatives.

Creating positive impact for future generations

In 2022, the LEGO Group continued work to make its business and products more sustainable. The company began to transition to paper-based bags in LEGO boxes, putting it on track to make all its packaging from more sustainable sources by the end of 2025. In its factories, it continued to invest in reducing waste, operating more energy efficiently and expanding production and use of solar energy.

The LEGO Group is committed to improve representation and remove gender stereotypes in its portfolio and marketing activity. Over the past year, the company introduced differently abled characters into its LEGO sets and the LEGO Friends range was reimagined to celebrate the diversity and optimism of today’s children.

The company’s social responsibility efforts saw it reach more than 9.8 million children and families in need via Learning through Play programmes in local communities with partners, such as Save the Children and UNICEF.

Christiansen said: “We are grateful that our financial momentum makes it possible to continue to support children in need and bring more Learning through Play opportunities to children everywhere.”

Preliminary Insights:

Some fun stats:

- Net profit margin -11% YoY

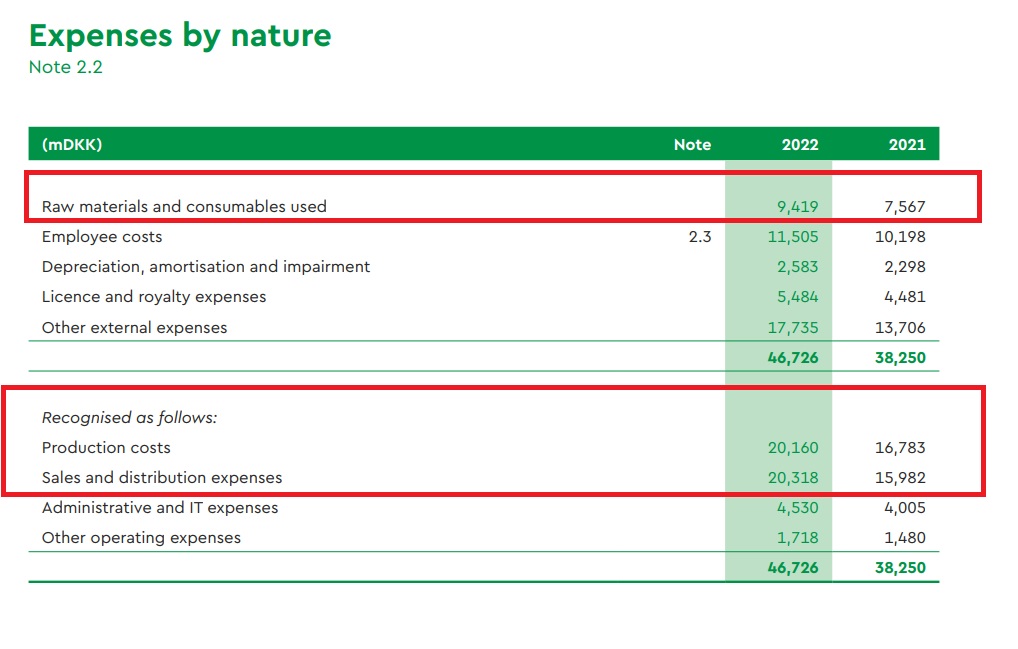

- US$786m spend on licensing, up 22.3%

- Raw materials cost up 24.4%, Sales & Distribution (read discounting) up 27%, and Production costs up 20%

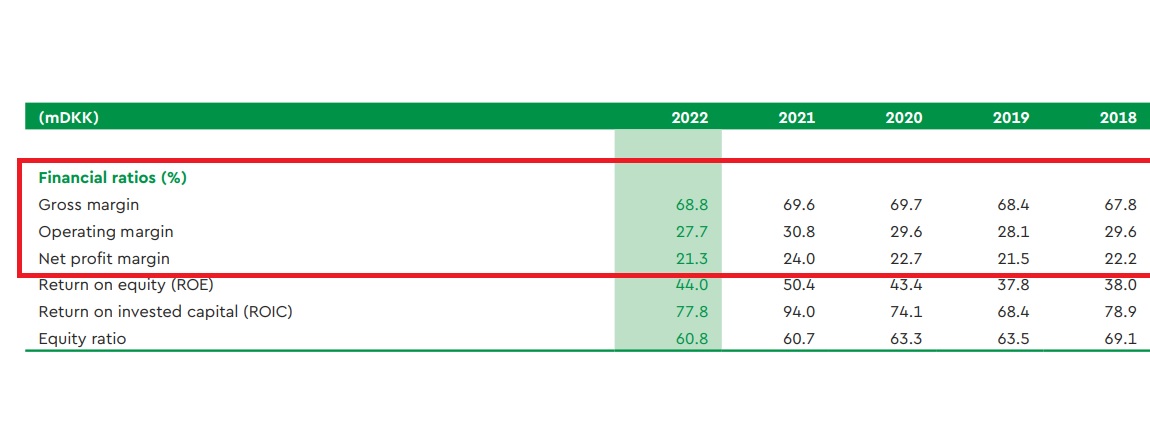

There are a few things that stood out – while it’s admirable that LEGO has grown their revenue against incredibly strong headwinds against the toy and discretionary market, you can see that things like the cost of wages, and other operating expenses (like production costs have begun to chew into LEGO’s (still very healthy) margins, resulting in net profit not growing as much as revenue.

Marketing costs have also gone up, presumably to drive discounting and promotional offers with retailers looking to clear their inventory.

That said, their net profit and operating margins are among their lowest in the last 5 years.

They are also sitting on elevated levels of inventory, up up 58% YOY up from 47,991 million DKK to 55192 million DKK, an increase of 15% as LEGO builds and holds on to more stock.

(Thanks James for the correction)

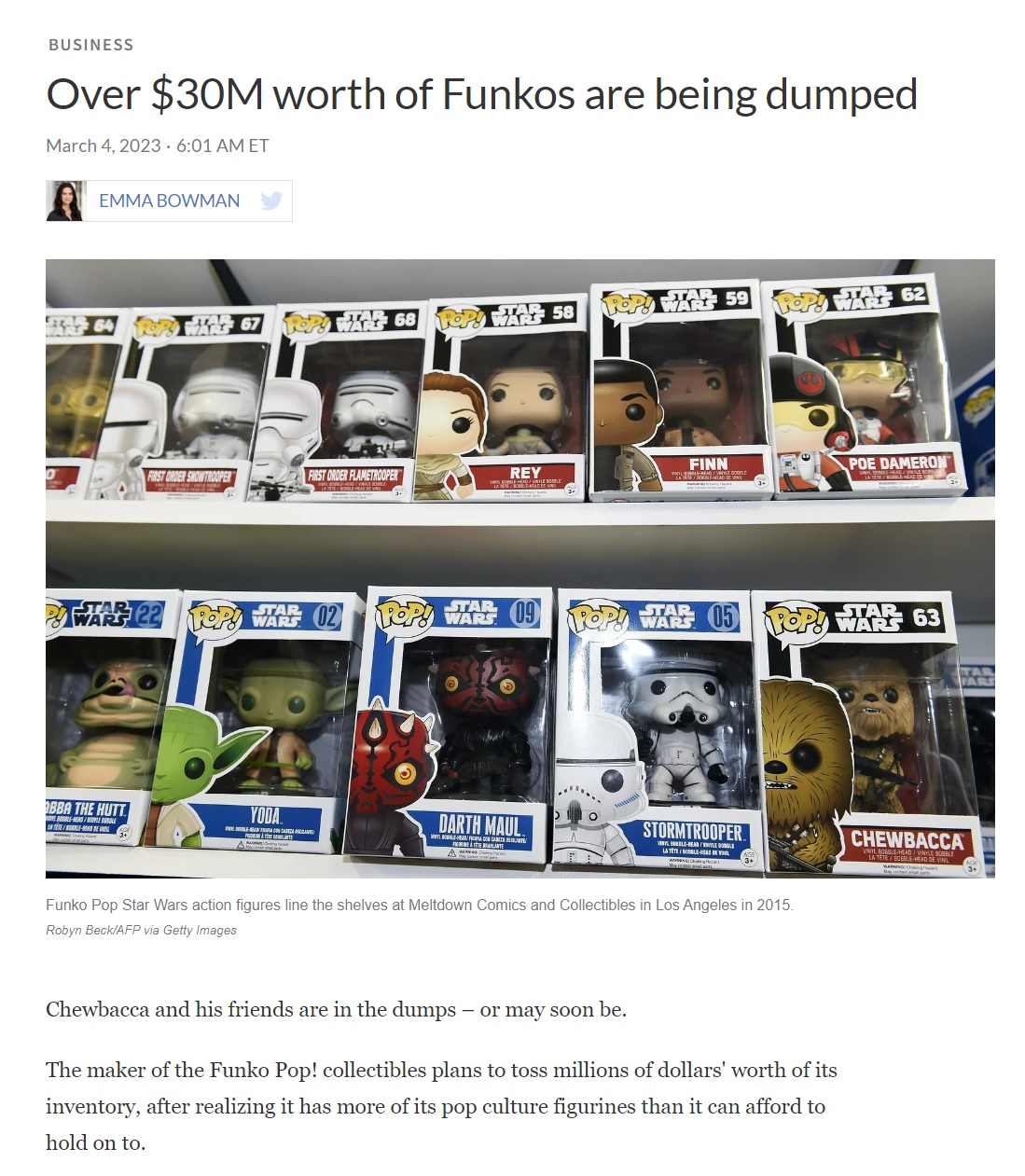

Ultimately, The LEGO Group is incredibly well-run, and this is most evident when you stack them up against their natural competitors – Funko, Mattel, and Hasbro who were all clobbered in their Q4 and Full Year 2022 earnings due to slowing consumer demand.

Update: an earlier graph had an error with currency and this has been corrected

This of course drove the unprecedented Price Increases in August/September 2022 (wow, remember that?)

I don’t believe LEGO is completely out of the woods yet, as the full year earnings benefited from the Christmas holiday shopping season, and it’ll be really telling to see what their 1HY (first half) of 2023 results will look like, especially as inflation stubbornly persists, and consumers tighten their discretionary spending belts.

That said, LEGO has traditionally been a very conservative company, and benefits from being one of the most beloved brands on the market, which will ensure that it will continue to be able to command impressive margins.

They are also still hiring aggressively throughout the company, which is a good sign.

Update: Nothing that interesting from the earnings call, but LEGO does expect single-digit revenue growth in 2023, given the challenging conditions in the market.

To get the latest LEGO news and LEGO Reviews straight in your inbox, subscribe via email, or you can also follow on Google News, or socials on Facebook, Instagram (@jayong28), Twitter or subscribe to the Jay’s Brick Blog Youtube channel.