LEGO delivers record first half (H1) of 2022 results with over US$3.4bn in revenue

18

18

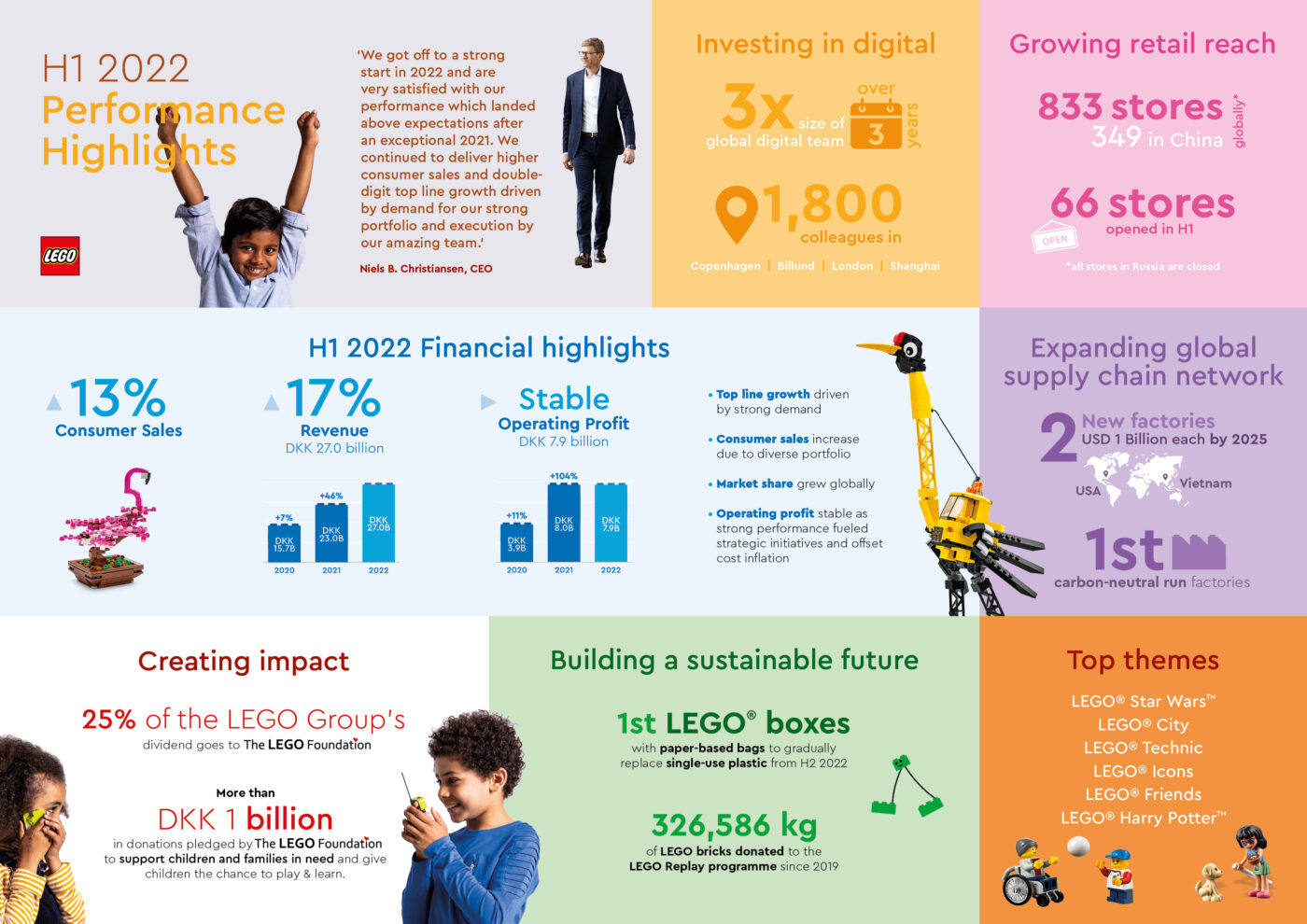

LEGO’s monster growth trajectory continues to show no signs of slowing down, despite a challenging economy and operating environment as The LEGO Group today announced its first half of 2022 (H1) results, revenue growing 17% to 27 billion Danish Krone (approx US$3.4bn) and net profit hitting 6.2 DKK (approx US$795m)

- Revenue grew 17 percent to DKK 27.0 billion.

- Consumer sales grew 13 percent.

- Operating profit was stable at DKK 7.9 billion. Net profit was DKK 6.2 billion.

- Free cash flow was DKK 3.8 billion.

- Market share gains globally and in largest markets.

- The LEGO Foundation continues pledge to support families in need and children’s development through playful learning.

Overall, it seems like another great half for LEGO, largely thanks to the massive number of sets being release. LEGO has called out that this year is their largest portfolio ever, and most fans can certainly attest to it, what with the unrelenting assault on their wallets.

It’s always nice seeing a breakdown of LEGO’s top themes, and they’ve called out 6 this time, with LEGO Star Wars, City, Technic, Icons, Friends and Harry Potter (in no particular order) making up the list.

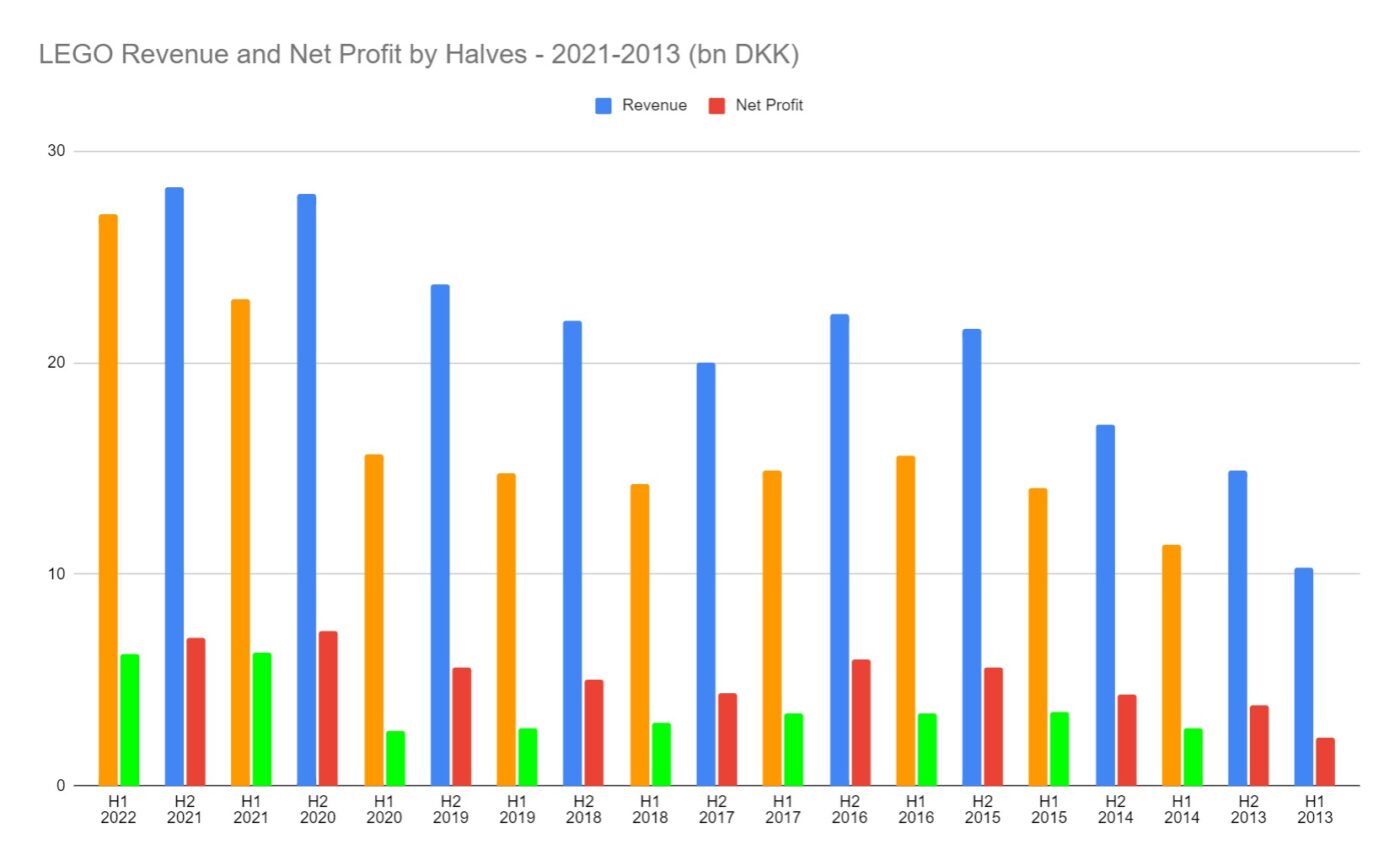

Zooming out, here’s how H1 2022 compares against previous halves – LEGO being a toy company typically makes most of their money in the second half of the year, but H1 is usually a good indicator of how they’ll perform in 2022.

A few interesting things stick out, and here, we can start seeing why LEGO announced that they were increasing the price of sets earlier this year – when you compare 2022 against the previous year, while they were able to increase revenue by 17% (about 4bn DKK), net profit actually declined by 0.1bn – which largely points to LEGO’s (very huge) margins slowly getting eroded, as the cost of goods, materials, energy and overheads go up due to inflation.

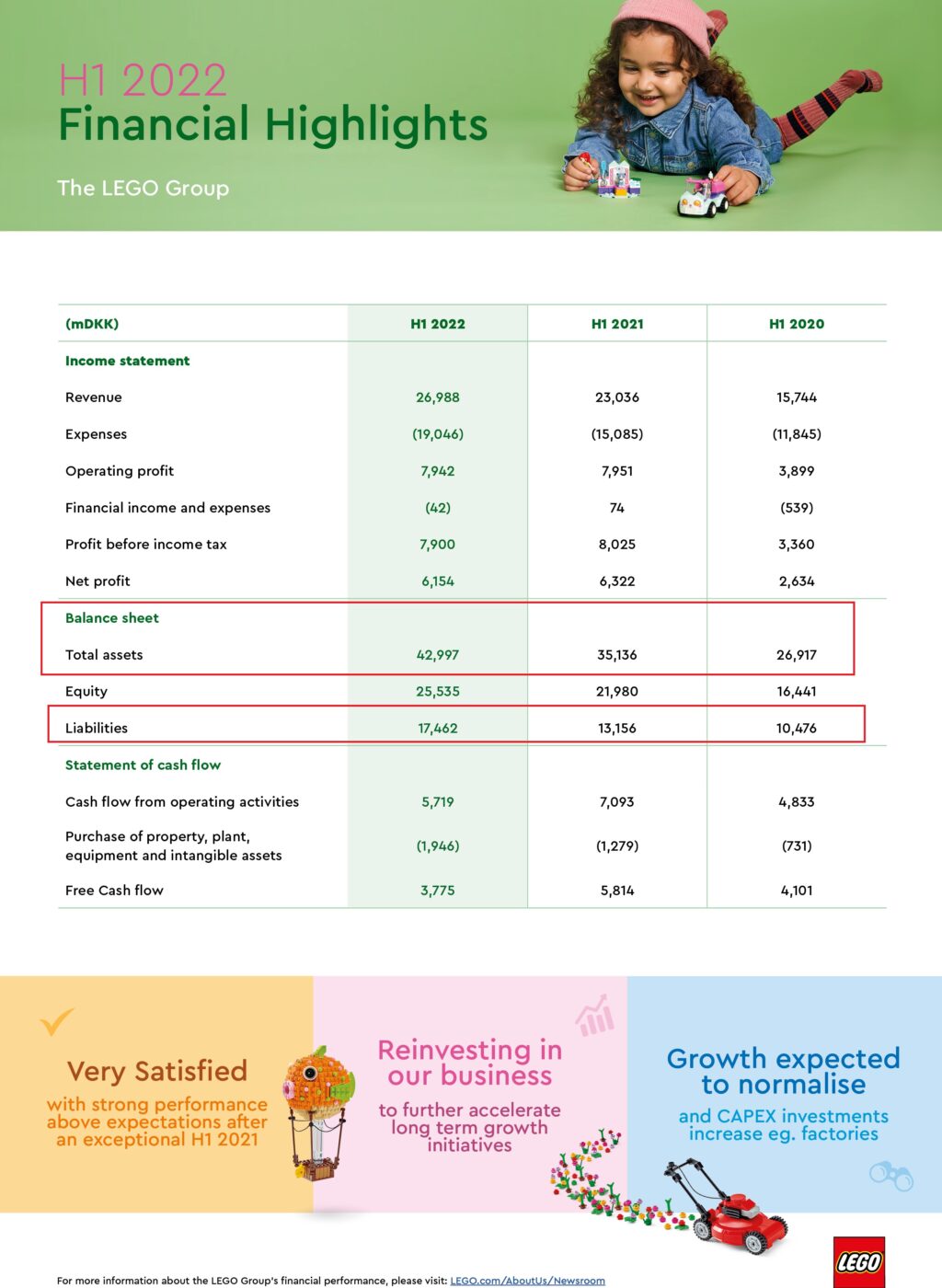

Another slightly worrying sign, and something that has been negatively impacting retailers across the world is LEGO’s ballooning inventory.

On their balance sheet, they have about 42 billion DKK in assets, which I’m assuming is mostly inventory – that points to a LOT of LEGO that’s currently in warehouses, or in production that are waiting to be sold, much higher than comparable periods in the last 2 years.

Liabilities, which can sometimes include deferred revenue (not sure here as LEGO doesn’t provide details), is also up to 17.4bn DKK, about 35% higher than last year.

This is not good if you’re LEGO, but probably a good sign if you’re a consumer, as you can expect retailers (and LEGO themselves) to resort to discounts to clear their stock before the end of the year, hopefully offsetting some of those price increases.

Lastly, under the Expenses section, which includes overheads, wages, and materials, you can also see just how big of a jump it was compared to 2021 and 2020. LEGO have been on a growth trajectory, and have been hiring and building up more capabilities, and inflation is probably affecting this line hard as well.

Overall – still a really good result considering challenging circumstances, the war in Ukraine, and a highly inflationary environment, but it looks like people are still buying more LEGO than ever before with consumer sales up 13%.

But zero-ing in on LEGO’s net profit should probably be a wake up call for a popular trope that LEGO is continuing to fleece consumers and be greedy with price increases because we can now see that LEGO’s bottom line has been materially impacted, and I can only imagine that it’ll get worse in the second half of 2022, especially if consumers begin pulling back spend.

See below for the full press release

The LEGO Group delivers top line growth in H1 2022 while accelerating strategic growth initiatives

BILLUND, September 28, 2022: The LEGO Group today reported earnings for the six months ending June 30, 2022. Revenue for the period grew 17 percent to DKK 27.0 billion compared with the same period in 2021, driven by strong demand. Consumer sales grew 13 percent, significantly ahead of the toy industry, contributing to global market share growth.

The LEGO Group CEO, Niels B. Christiansen said: “We got off to a strong start in 2022 and are very satisfied with our performance which landed above expectations after an exceptional 2021. Despite global uncertainties, we continued to deliver higher consumer sales and double-digit top line growth driven by demand for our strong portfolio and execution by our amazing team.

“Across the world, we celebrated our 90th anniversary and are grateful that after nearly a century LEGO® play remains relevant and continues to inspire families and children.”

The strong revenue growth and free cash flow allowed the LEGO Group to significantly accelerate strategic initiatives and offset cost inflation on raw materials, energy and freight while keeping operating profit stable at DKK 7.9 billion.

In the first half of 2022, the LEGO Group focused on expanding manufacturing capacity and building healthier inventory levels while increasing productivity following an extended period of exceptional growth rates and maxed out capacity in 2021. Due to these accelerated investments, free cash flow was DKK 3.8 billion, compared to DKK 5.8 billion in the same period last year. Net profit stayed solid at DKK 6.2 billion matching the extraordinary result in the same period last year.

Christiansen said: “For the second half of 2022, we continue to see strong demand for our products. Longer-term we expect top line growth to normalise to more sustainable levels. We will also continue to reinvest in our business and accelerate initiatives such as product innovation, digitalisation, production capacity, our retail network and sustainability to maintain momentum and deliver sustainable growth in the long-term. These significant investments will position us well in the future to bring learning through play to more children around the world.”

Strong portfolio appeals to fans of all ages and interests

During the first six months of 2022, consumer sales grew in all market groups, with especially strong performances in the Americas, Western Europe and Asia Pacific. The growth was driven by the continued demand for the company’s extensive and diverse product portfolio. Top themes in the first half included LEGO® Star Wars™, LEGO® Technic, LEGO® Icons (formerly Creator Expert), LEGO® City, LEGO® Harry Potter™ and LEGO® Friends.

This year’s portfolio is the largest on record and caters for builders of all skill levels and ages. It includes LEGO products that reflect a wide range of interests and hobbies our builders are passionate about from art and design and cars to music, sport and space exploration.

In April, the LEGO Group announced a long-term partnership with Epic Games which will see the two companies join forces to create fun, safe digital experiences for kids in the metaverse and inspired by the endless possibility of the LEGO brick.

Strategic growth initiatives drive reach, relevance and a digital future

The company expanded its global store network in the first six months, opening 66 new LEGO stores, 46 of which were in China. This takes the number of stores globally to 833. The company also strengthened e-commerce capabilities across its own and its partners’ online platforms.

In June, the LEGO Group officially opened a Digital Hub in Copenhagen while growing the global digital team nearly 40 percent in the first six months of 2022. Over a three-year period, it is committed to triple the size to 1,800 colleagues globally while strengthening e-commerce, upgrading digital infrastructure and driving an enterprise-wide digital transformation.

The LEGO Group made progress against its ambition to make its packaging from sustainably sourced materials by the end of 2025. In the second half of 2022, it will begin to roll out paper-based packaging in LEGO boxes in Europe.

In June, the company announced plans to open its second carbon-neutral run factory in Virginia, United States, in addition to the factory announced in Vietnam late last year. Both sites’ energy requirements will be matched by energy from onsite renewable sources.

Creating impact for children and families

The LEGO Foundation, which receives 25 percent of the LEGO Group’s dividends, pledged more than DKK 1 billion in donations in the first half of 2022 to support families in need and children’s development. Some of the programmes funded included a global competition aimed at giving children the best start in life; support for neurodivergent children; and support for children and families impacted by the war in Ukraine.

Christiansen said: “We are fortunate that our strong financial performance allows us to make a positive contribution to society and invest in the company’s future so we can bring learning through play to children everywhere.”